Tutorials

Project Implementation Unit CLICK has developed an interactive guide to registration of various licenses and permits required for doing business in Sindh. These tutorials provide a simple guide through the Regulatory requirements to obtain a specific business license or permit.

2 videos

Play All

Labour and Human Resources Department

View All Videos

2 videos

Play All

Agriculture Department

View All Videos

3 videos

Play All

Health Department

View All Videos

1 videos

Play All

School Education and Literacy Department

View All Videos

1 videos

Play All

Sindh Health Care Commission

View All Videos

9 videos

Play All

Industries and Commerce Department

View All Videos

5 videos

Play All

Sindh Environmental Protection Agency (SEPA)

View All Videos

11 videos

Play All

Sindh Industrial Trading Estate (S.I.T.E) Limited

View All Videos

1 videos

Play All

Board of Revenue

View All Videos

1 videos

Play All

Excise, Taxation & Narcotics Control Department

View All Videos

18 videos

Play All

Karachi Metropolitan Corporation (KMC)

View All Videos

12 videos

Play All

Sindh Building Control Authority (SBCA)

View All Videos

1 videos

Play All

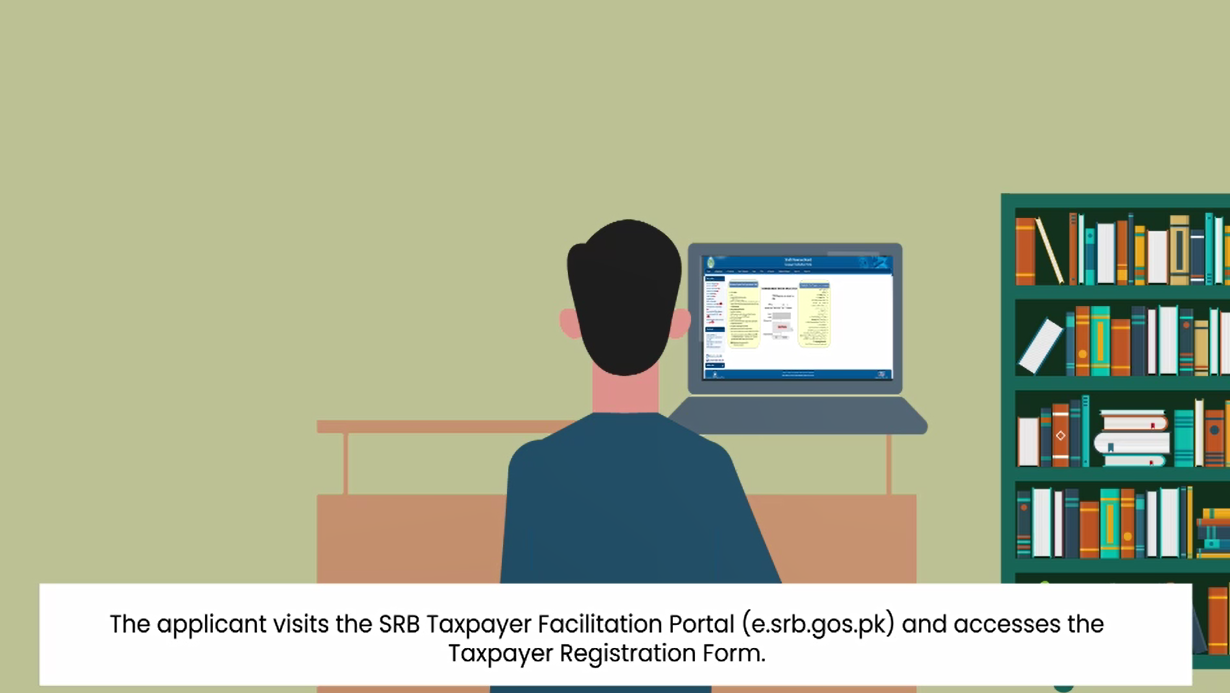

Sindh Revenue Board

View All Videos

3 videos

Play All

District Municipal Corporation (DMC)

View All Videos

1 videos

Play All

Sindh Education Department

View All Videos